Household debt relief programs by the CCRS

Household debt relief programs offered by the CCRS help over-indebted individuals regain financial stability through measures such as extending repayment periods, offering installment repayment options, reducing interest rates, and partially or fully discharging debt.

Established under the 「Microfinance Support Act」, CCRS household debt relief programs help you manage debts owed to financial institutions that have entered into the Agreement on Debt Relief Support.

| Content | Details |

|---|---|

| Eligibility |

In order to apply, you must meet all of the following conditions :

|

| Reduction and discharge of debt |

|

| Extension of Repayment Period |

|

| Postponement of Payments |

|

| Content | Details |

|---|---|

| Eligibility |

In order to apply, you must meet all of the following :

|

| Interest Rate Reduction |

|

| Extension of Repayment Period |

|

| Forbearance |

|

| Content | Details |

|---|---|

| Eligibility |

In order to apply, you must meet all of the following :

|

| Reduction and Discharge of Debt |

|

| Extension of Repayment Period |

|

| Postponement of Payments |

|

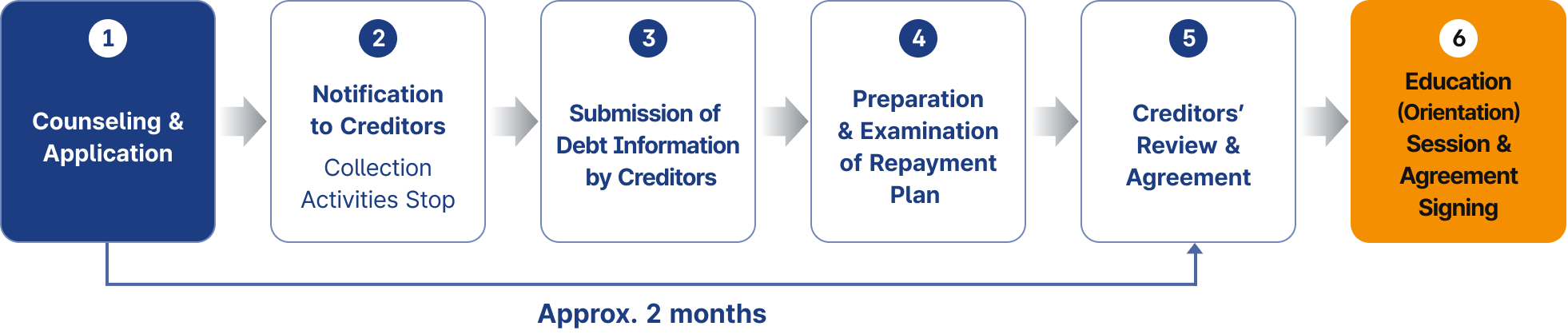

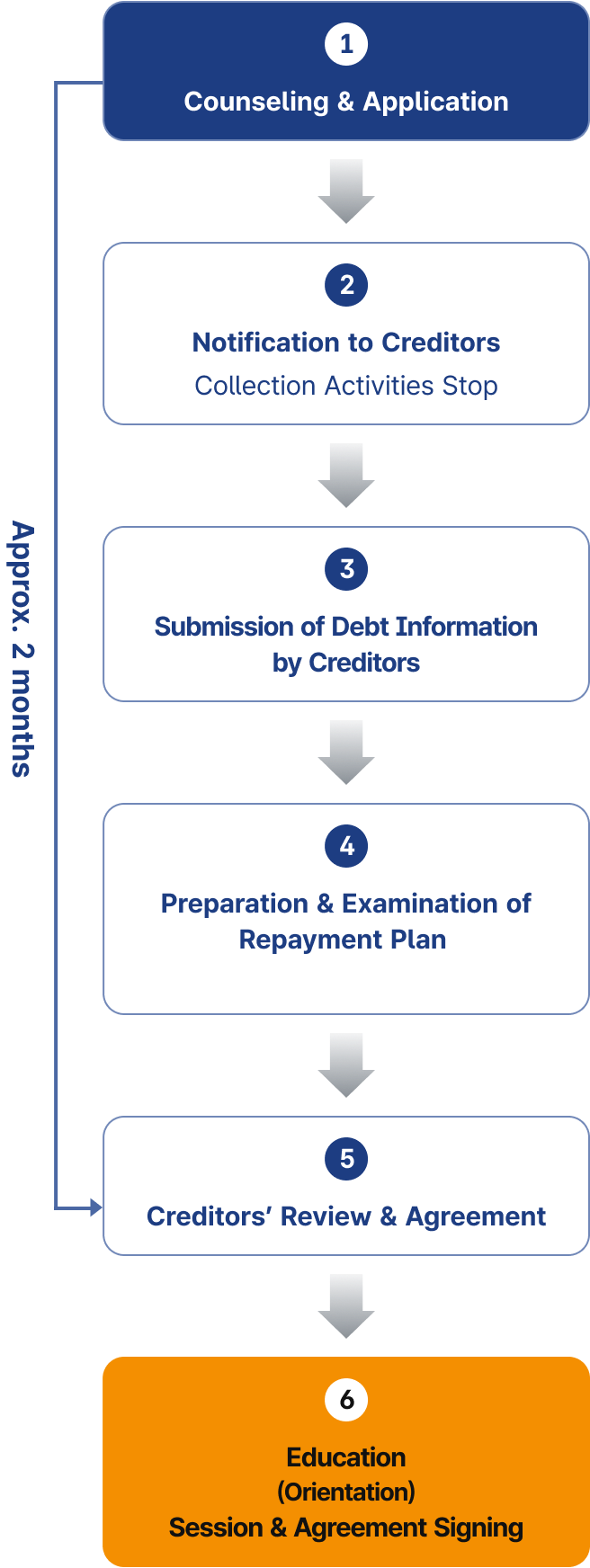

- Collection activities are suspended starting the day after application.

- Only a KRW 50,000 application fee applies; no additional costs are required.

- Unsecured debts with participating financial institutions are consolidated into a single monthly payment.

- Direct coordination with financial institutions enables faster processing.

- The application process and required documents are simple, allowing same-day application during your first visit.

- Online application is available for individuals unable to visit in person.

If you are struggling to repay your debts or are facing bankruptcy, we provide support with filing for individual rehabilitation or bankruptcy.

- We offer free assistance in preparing required documents, including application forms and repayment schedules.

- The Korea Legal Aid Corporation and our in-house attorneys support the legal procedures.

- In addition, Fast-Track Agreements with courts nationwide enable a simplified and expedited filing process.

If you make steady payments according to your repayment schedule for a designated period, you may be eligible for various benefits, including :

- Early removal of public records from credit reports

- Access to small-amount emergency living-expense loans (microfinance)

- Eligibility to obtain new credit/debit cards from designated financial institutions